There is a massive shortage of accountants in countries around the globe.

That’s not the sentence we ever thought we’d have to type. An international accountants shortage doesn’t feel like it could have been a thing.

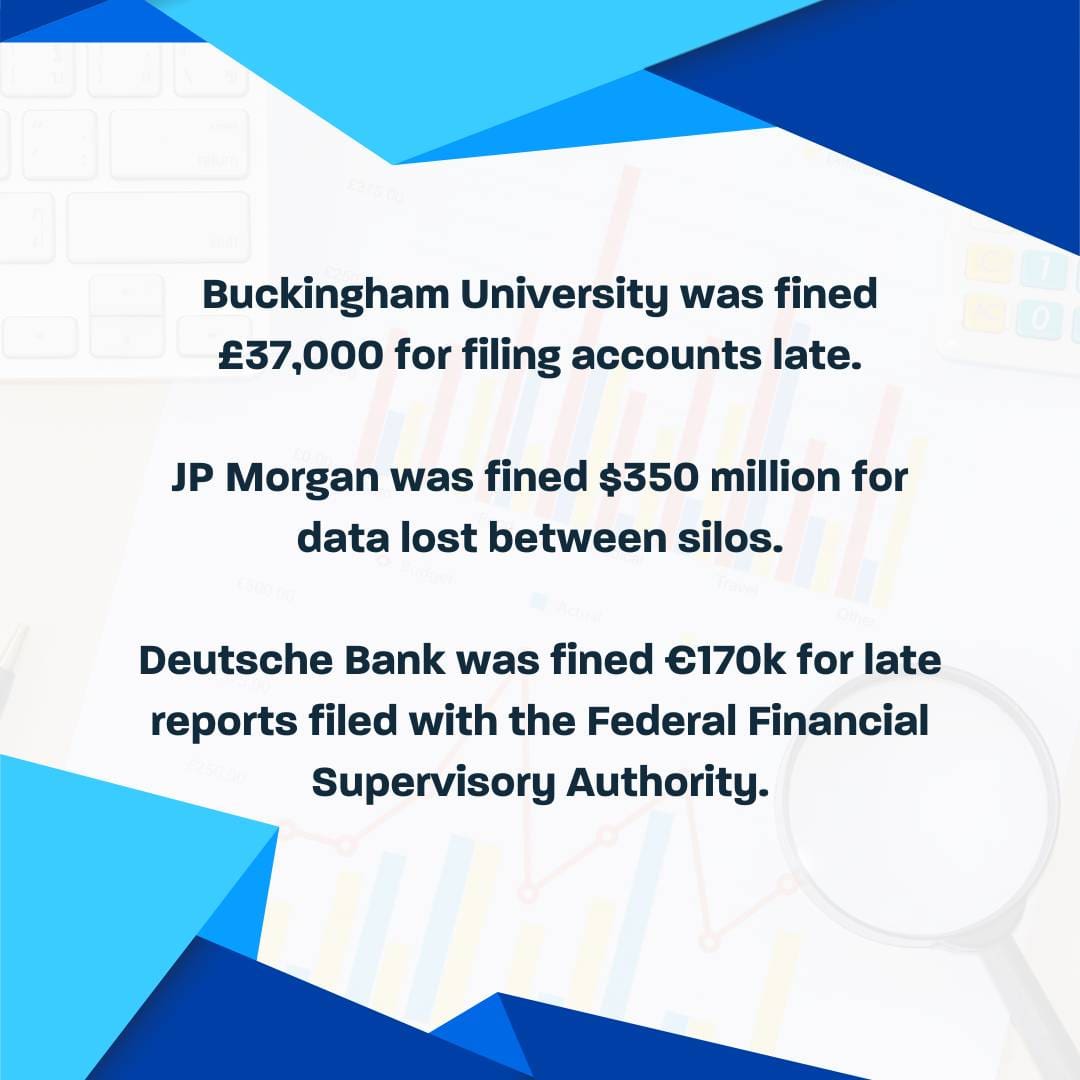

But right now, businesses are suffering because they can’t get the staff they need to keep revenue and accounts moving. That’s a lot of stress. It impacts everything in the accounting cycle – for example, huge delays in filing mandatory reports.

We saw how these problems work specifically with Tupperware when the company’s experiences with the accountant shortage went to court. They had not only experienced revenue operational headaches but were struggling with financial reporting accuracy and regulatory compliance.

Tupperware maintained it simply didn’t have enough accountants to get its annual report out on time. And the storage container manufacturer isn’t alone;

In this article, we’re going to talk through the accounting shortage, and how it impacts subscription companies like yours, especially in light of revenue recognition. We’ll also cover what can be done to ensure that your brand doesn’t go through the same problems.

Why There’s a Shortage

There are a couple of reasons for the accounting shortage:

- A whopping 75% of certified accountants reached retirement age since 2020.

- The profession has a bad reputation for long hours of repetitive work, with stressful annual cycles.

- Students are turned off by the extra year of expensive university courses needed for accounting qualifications when the base salary is only around $62k.

It’s only going to get worse. The US Bureau of Labor Statistics projects there will be 126,500 openings for accountants and auditors each year, on average, over the coming decade.

That means that companies are going to have to shell out enough money to make accounting irresistible or find a different solution.

Accountants and Subscription Management

Accountants are crucial in subscription management. They’re responsible for everything from revenue recognition to invoicing, payments, reconciliation, reports and forecasting, and compliance.

Generally speaking, it can be difficult for them to keep up with all these manual processes at the best of times.

Some of these accountancy problems are fairly regular:

- Inaccurate revenue recognition that constantly throws off revenue numbers

- Errors in invoicing from incorrect terms to inaccurate usage charges, and unawareness of customer account updates

- Numbers that the C-Suite can’t rely on for good decision-making

That’s just the tip of the iceberg. We want to stress that it’s not their fault. Generally, accountants aren’t given the resources they need to keep up with subscription management, especially when the company is scaling.

They’re set up for failure because there are only so many hours in the day. Human errors crop up. Miscommunications between departments cause mistakes. But in this business, accuracy and timeliness are essential to keep things like financial data, reporting, and compliance ticking over.

That’s why problems get a lot worse when there are fewer accountants to keep up with everything.

We’re seeing the worst-case scenarios come to life with Tupperware. For instance, the accounting firm PriceWaterhouseCoopers, dropped the company as a client. Last year, investors were warned about potential bankruptcy thanks to greater operational losses.

And it’s the same with other companies. Lyft mistakenly reported last year in its fourth-quarter earnings release that it expects profit margins to increase by 500 (not the 50 basis points it actually was) — which led its stock to surge 60%. Electric vehicle maker Rivian made typos in their reporting. So did Planet Fitness.

So what can a subscription business realistically do to avoid this epidemic?

Sidestepping the Accountant Shortage

You can sidestep this resource crisis altogether. The easiest and safest solution comes down to one thing: harmonized processes automated through an end-to-end subscription platform.

The best subscription management software can completely change accounting workflows and guard your FinOps and compliance. All with the proverbial flick of a switch.

Here’s what automated accountancy can do for your financial processes:

- It automates tedious and time-consuming tasks

- Ensures accuracy, eliminating manual errors from the invoicing process

- Ends silos by real-time sharing of terms and contracts with sales/customer service

- Recognises revenue, taking into account any last-minute changes

- Tracks compliance across regions and countries, including changes in legislation

- Tracks resource allocation with customers and integrates it into the invoicing process

- Creates reports and forecasts whenever they are needed, using real-time numbers

- Collects payments in the customer’s preferred methods

- Reconciles everything back to the ledger

- Keeps communication accurate and transparent with customers

- Mitigates risk

That means fewer problems for you. Fewer errors. Fewer delays in reporting. Fewer compliance issues.

Subscription management software streamlines your financial processes and improves your overall business performance. And the software enables you to scale easily.

And that means your company circumvents the entire problem.

It’s not often in business that there’s a simple solution to a massive, complicated problem. But we’re seeing what can happen to companies that don’t invest in the solution.

Automaton is not only compelling but necessary. Because the problem is only going to get worse.

But if your company leverages automation to streamline accountant workflows, you’ll not only benefit from cost savings, but better financial accuracy, easier scaling, far less compliance risk and an overall happier workforce.

You’ll also get more agility, reliability, and the strategic foresight you need to get the advantage over your competitors.

Sound good?

Say goodbye to manual sales processes and boost your growth with Bluefort’s cutting-edge automation solutions. Learn how our end-to-end system streamlines the end-to-end process.

More Bluefort insights...

Ready to supercharge your SaaS revenue with automation? Discover how Bluefort can transform your upselling and cross-selling game.

Schedule a free, no-obligation call today to see how we can revolutionize your financial management.