Let’s talk about the lifeblood of financial management for your subscription business: revenue recognition.

It’s what keeps your decision-making, financial reporting, and accounting standards compliance in tip-top shape.

The thing is that dealing with revenue recognition the traditional way is a huge ask. That’s because subscription management teams are often stretched so thin and between hopping in and out of countless spreadheets and the lack of resources, it’s impossible to keep up.

That’s why the customers who have chosen LISA BusinessPro’s revenue recognition automation have been relieved of all the day-to-day processes. It’s all automated for them.

You might be new to LISA BusinessPro or curious about how it works.

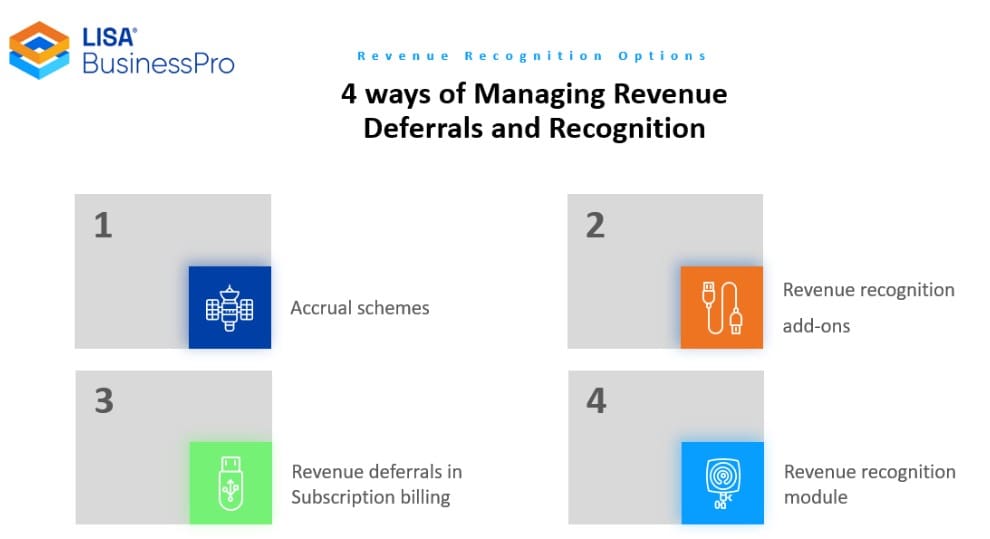

So here’s a short guide to 4 different ways you can set up revenue recognition with Dynamics Finance using LISA BusinessPro.

1. The Accrual Scheme

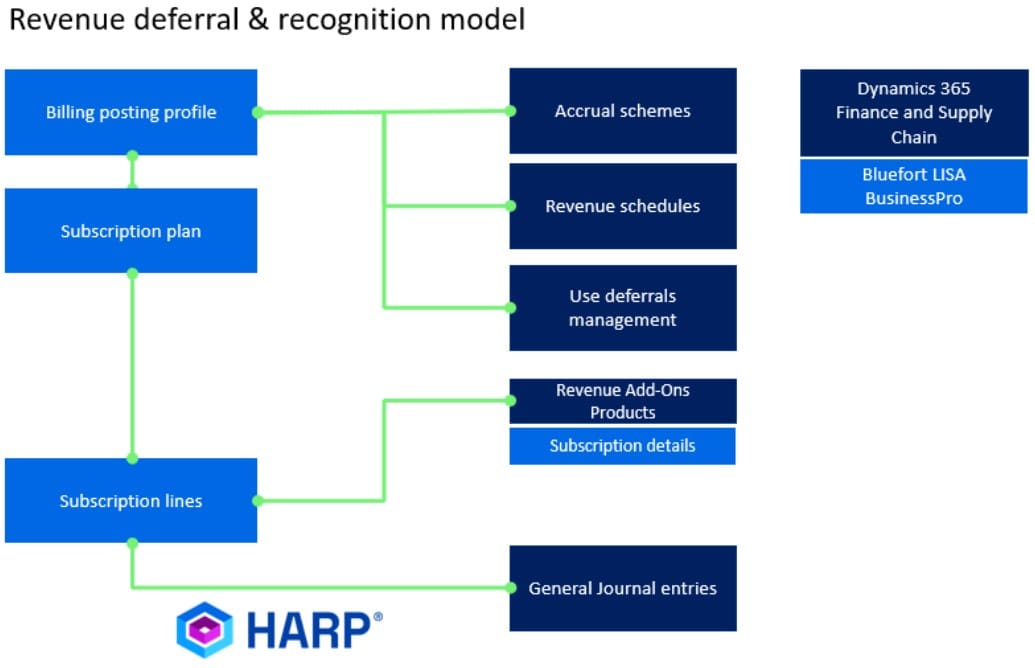

If your subscription business is sailing smoothly with minimal subscription changes, this will be the method for you. It kicks in with the billing process and needs future-dated postings. You set up the billing posting profile adding sales and purchase accruals. That means the right billing posting profile can be automatically assigned based on the length of the subscription if you use the “automatic billing posting” feature.

Be aware that you’ll need to set up a billing posting profile and an accrual scheme for each subscription contract duration. Also note that with the accrual scheme, you can split the revenue and send a chunk of it straight to your profit and loss when you bill.

2. Revenue Recognition Add-Ons

If you want more control over how revenue should be deferred and recognised, this is the way to go. With HARP BusinessPro (the automation engine that lies underneath LISA BusinessPro), you can create actions that handle revenue recognition separate to billing.

Plus, you can slice up your revenue into different components before posting it to the general ledger. And this can be done on a product-by-product basis.

3. Revenue Deferrals in Subscription Billing

If you’re all about flexibility but you don’t need a lot of detailed revenue allocations, this is the method for you. In subscription billing, revenue deferrals need monthly revenue recognition postings that are based on all the orders and credit notes you’ve processed during that time.

This method allows you to deferrals and recognition to be posted separately from the billing events you have.

4. Revenue Recognition Module

[Heads up – this method is for use only in the short-term action as Microsoft is planning to retire it soon.]

This module can be triggered by the subscription billing action, so it executes on posting. You’ll need to set the “use revenue schedules” flag to yes and link your revenue schedule to the billing posting profile.

LISA BusinessPro and Dynamics 365 Finance gives you a lot of options for processing your revenue recognition. And each one can make a huge difference on how accurate and efficient your financial management is. It can also save you so much time and effort.

It’s just about choosing the one that best suits your business. But once you pick the one that fits you like a glove, you’ll notice a change right away – less time, fewer errors and more accurate accounts.

As always, if you have any questions, please feel free to get in touch. We’re here to listen and help.