It’s 7:53 AM on an office Monday, and a few people are already on their second cup. This is not a happy place.

This is a place where chaos feels at home.

The revenue team’s buried under one jillion spreadsheets. So. Many. Spreadsheets.

They desperately add and subtract and divide and check and re-check and cross-check with the sales team down the hall.

By 9:27, Saurah, the team lead, scans the new pile of contracts and revenue bookings from last week. She sighs, and wonders what happened to her life and is this all there is and how different it would all be if only when she was 14 she had waited till her mom wasn’t looking and sprinted through that striped tent and joined the travelling circus with the cute white tiger.

By 10:30 AM, is an absolute war zone and the munitions seem to be papers. People barking demands. Hurry. Close of cycle. Is it ready for the audit??!!!?

And then…Saurah spots Mark, whose face has gone paler than a goth awards show. Why?

Besides the revenue bookings being a total mess because no one’s got the time to work out all that recognized revenue, he’s just found an error that could throw off the entire month’s projections just before the CFO’s meeting with the stakeholders.

Who’s gonna tell the boss?!?

Not me.

Absolutely not me. I did it last time.

So lunchtime rolls around, and every single one of the team silently take their jackets, and shuffle out of the front door, never to be found again, even by the people from CSI (the good CSI).

In the SaaS world, this scenario happens at least 735 times a day.

Okay, maybe we’re exaggerating. (It’s probably more like 15 times a day)

But the point is that if your team still does manual entries, that office ain’t gonna be a pretty place to work. No matter how much they do, it will never be enough. And you’re the one who will have to catch the heat for it.

It’s down to you

As a CFO, your role is to steer your company to growth, stability, and profitability. That means all your decisions have to be driven by the numbers you’re given. Those numbers come from your team.

Manual data entry and revenue bookings might seem routine, but they have so many issues. They suck up your team’s time and energy. They bring no value whatsoever. They seem to have errors secretly planted into them.

That means that you and your team are stuck putting out fires, unable to do the high-value strategic work that would help you reach your goals.

That’s why we wrote this article. Like you, we’re a SaaS company. And we talk to a lot of CFOs stuck in the abyss of manual processes.

You’ve all got something in common- you know that manual processes are an absolute nightmare. So let’s talk about the problems with manual processes, how they impact you and your company, and what can save you from these problems and secure your revenue for good.

Why Manual Processes Make Your Team (and you) Fantasize About Running Away Forever

In SaaS, everyone is busy, so efficiency is key. But manual processes are a huge roadblock. Here are just some of the things they cause:

Time and resource drain – Every single contract and spreadsheet and form has to be checked entered into the system. According to CFO Dive, if you have a finance team of 20 people, you’ll lose the equivalent of 1,920 work hours every year.

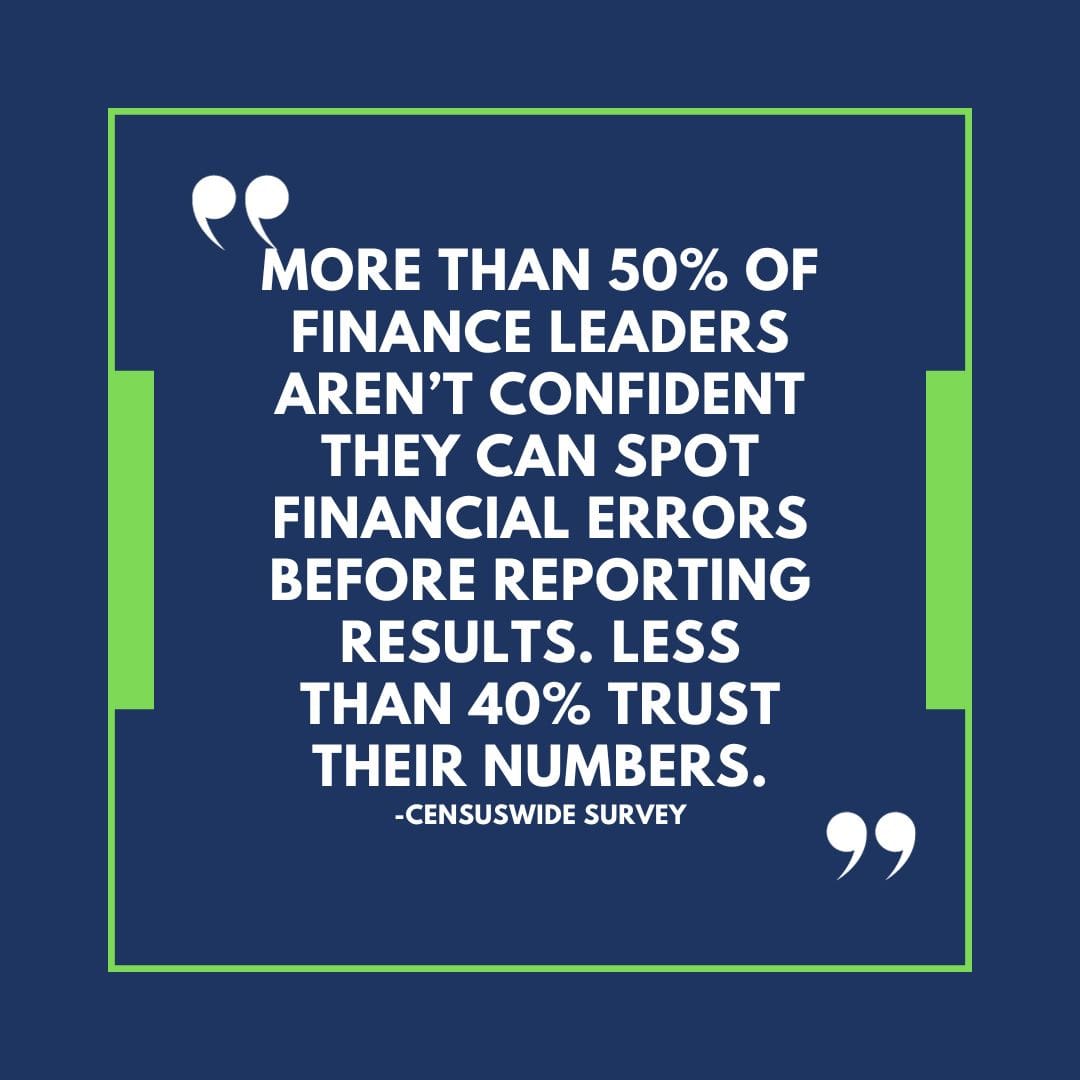

More mistakes – You cannot avoid human error. The more chances there are for mistakes, the more you’ll have. Those mistakes mean you won’t have to data you need to make the best decisions possible.

No strategic value – You don’t get any insights from manual data entry. It doesn’t contribute to the company’s health. It can’t help you with forecasts. .

Impact on employee morale – Manual data crushes the human spirit and will have your employees eyeing up the buildings escape routes 24-7. That is a fact.

Regulatory compliance risks – Any mistakes in revenue recorded can lead to financial penalties and damage to your reputation. Another layer of worry for you!

Delayed reporting – Because manual processes slow things up, your financial reports are not only possibly incorrect, but also late. Stakeholders and the C-Suite aren’t fans of that.

It’s not just that manual processes are inconvenient. They can damage your company and make your goals impossible.

But there is a way to sort out these problems AND make your bottom line better.

The Solution: Automating the End-to-End Process

Bringing in automation will change everything for you.

You might bristle at the word. It might feel like too big a move. Your team might feel like it’s too much an effort.

The thing is that you’re a SaaS company – you know how important it is to innovate.

You know the benefits that innovation can bring. That’s why you develop products for your customers.

So what can automating your end-to-end financial processes do for you? Imagine having all this:

Efficiency and time savings – You get all those hundreds or thousands of hours back that are currently stolen by data entry and other manual processes. That means your revenue team can finally put their talents to more strategic tasks that will bring more revenue in.

Fewer mistakes – Automated processes are accurate and cut way back on costly errors. That means you get reliable financial statements, reports and forecasts that you can literally and figuratively take to the bank.

Strategic insights – You’ll get data-driven insights that find patterns, identify trends, and predict future revenue numbers. That means you’re able to make proactive decisions that can drive your company’s financial successes in the future.

Compliance – Compliance with financial regulations come automatically. No more late audits. No more costly mistakes. No more fines or compliance-based risk of lawsuits.

Happier employees – Everyone gets to do more fulfilling, high-value work, which leads to a lot more satisfaction.

You meeting your goals – This probably feels like he most impossible thing to imagine, but it’s true.

It’s Yours For the Taking

Being a CFO is no walk in the park, especially if manual processes make things impossible to navigate.

The last thing you need is the nightmare that manual tasks bring to you, your team, and your revenue bookings.

Automating the end-to-end process will make life so much easier for everyone involved. Your revenue bookings will mean something. You’ll have money streaming in. You’ll finally have numbers you can rely on at any given time.

And Saurah won’t fantasize about joining the circus again.

Recurring revenue businesses leak up to 5% in their billing processes.

Say goodbye to manual revenue processes and boost your growth with Bluefort’s cutting-edge automation solutions. Learn how our end-to-end system streamlines the end-to-end process.

More Bluefort insights...

Ready to supercharge your SaaS revenue with automation? Discover how Bluefort can transform your upselling and cross-selling game.

Schedule a free, no-obligation call today to see how we can revolutionize your financial management.